【Taiwan Stock Market Dynamics】TSMC's stock price has fallen back to 941 NT dollars… Netizens are actively discussing that it's "cheap and a good buy," while analysts warn of "potential selling pressure towards the end of trading."

- byVic

讀後心得

Today, the community is hotly discussing TSMC, with many netizens expressing concerns about the stock market, especially regarding the recent volatility of TSMC's stock price. The discussion mentions phenomena such as retail investors panic selling and the market turning negative at the end of trading. Experts have pointed out that TSMC faces unfavorable impacts from the economic environment in the United States and challenges related to low trading volume. Nevertheless, from a long-term investment perspective, the current stock price holds investment value, but the lack of clear positive news in the short term makes short-term trading inadvisable. As the Qingming Festival holidays approach, market risk aversion may further increase.

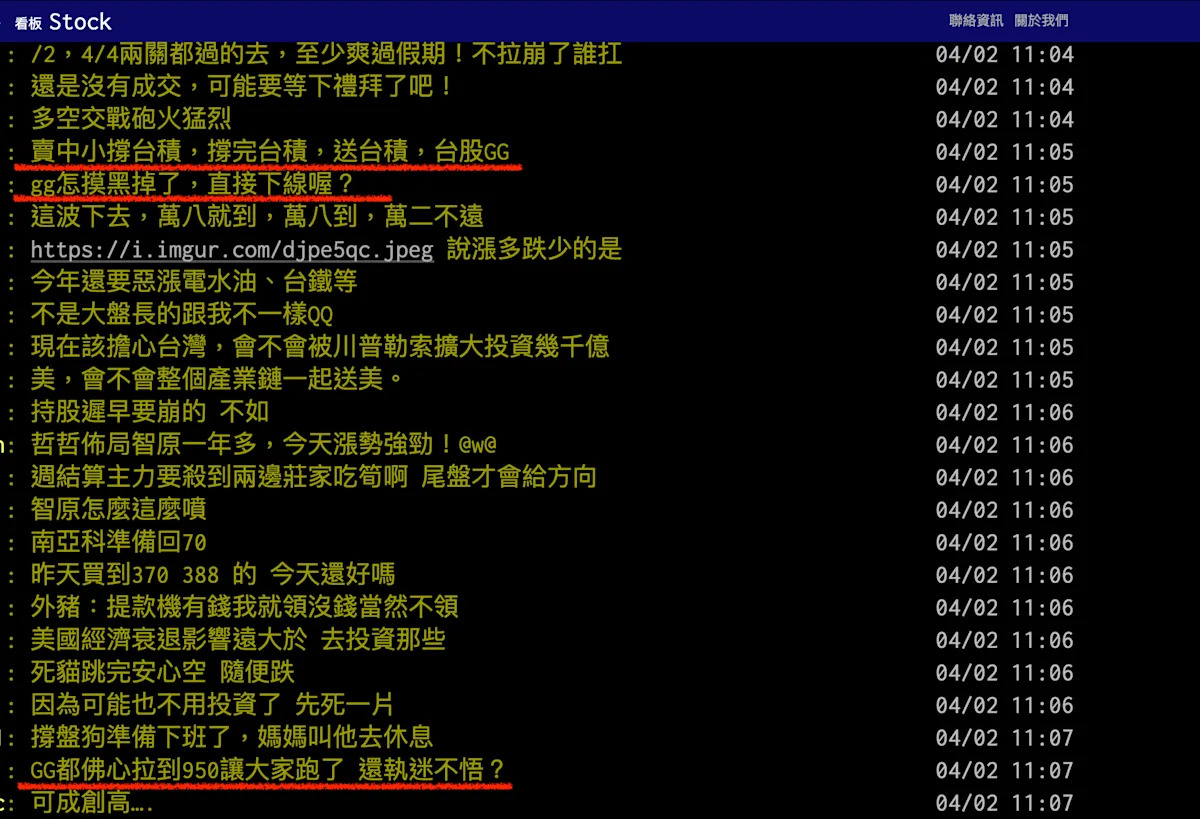

Today's popular topics on the Taiwanese stock market include: "Why did GG go black, is it offline now?" "Just now it was pulling GG, now it’s pressing GG." "Retail investors are panicking and dumping TSMC, history is repeating itself." "The buy and sell orders for TSMC are quite low." "Selling small-cap stocks to support TSMC, once it’s done, TSMC will be sent off, TSMC GG." "GG turned black at the end of the trading session." "GG is all black, it seems no one wants to bet during the long holiday." "GG has been sold off again, feel free to short it." "I have no plans to sell TSMC in the next three years, so I think it’s cheap to replenish my stock."

Further reading: The earnings report was not released on time, and trading will be suspended after the Qingming Festival! Hua Cheng dropped to a limit of 3 yuan, with nearly five thousand orders unable to be sold.

Today's popular topics among netizens include: "Awesome, the U.S. stock market crashed tonight, and I can short GG again." "It’s time to sell TSMC at the end of the trading day, the idiot operators won’t buy again." "Don’t be afraid, my funds are already in place to support the market, backing 1 share of TSMC." "GG was pulled to 950 to let everyone escape, still obsessed?" "GG has been sold down again." "Hope to see GG at 850 this month." "GG's rebound has ended." "There’s no need to stubbornly hold on to GG like a stubborn grandfather, let’s go down together hand in hand." "The 900 GG is worth waiting for, just wait for the escape wave."

In response to the heated discussions among netizens, experts have offered insights. A Moe Research analyst pointed out that TSMC's biggest challenge currently is the poor overall economic environment in the U.S., as the company plans to set up factories there with a total investment of $165 billion. In the long term, setting up factories in the U.S. is very favorable, but the additional capital requirement in the short term may suppress gross margins for the next 1 to 2 quarters, affecting stock performance. Furthermore, due to the upcoming Qingming holiday, market trading volume is relatively low, which limits the performance of large-cap stocks such as TSMC. Technically, TSMC’s stock price has fallen below all moving averages, but from the weekly candlestick chart, the price is stabilizing around the 60-day moving average (approximately 940 yuan). As long as it can hold this support level today, there will still be opportunities for a better rebound next week. Analysts believe that for long-term investors, the current price has investment value, but there is a lack of obvious positive news in the short term, coupled with insufficient market trading volume, therefore short-term trading is not recommended. Regarding today's end-of-day trend, with a four-day holiday approaching and the U.S. set to announce non-farm employment data and unemployment rates, market risk aversion has increased, which may lead to end-of-day selling pressure or a flat close.