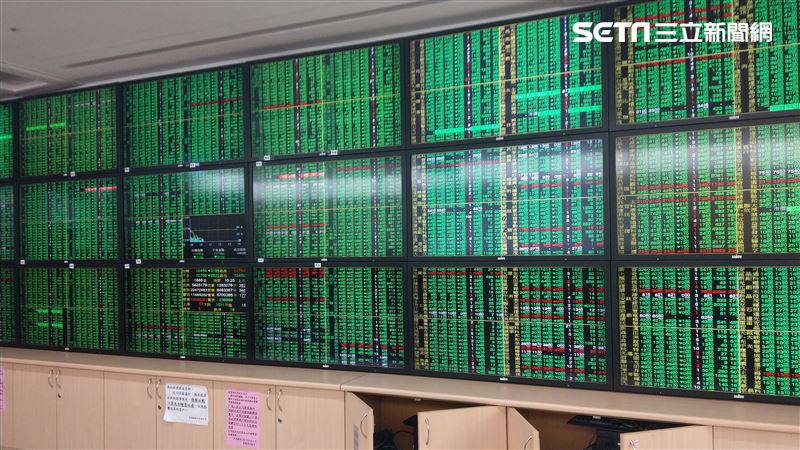

The opening situation of the Taiwan stock market is severe, and the "Futai Index" reveals the truth that it could plummet by 2,000 points.

- byVic

讀後心得

Taiwan's stock market is closed due to the Qingming Festival holiday, and the impact of Trump's tariff policy has yet to be seen, but investors are filled with concern over the expected drop after the opening. Affected by the U.S. stock market bear market, the FTSE Taiwan Index has already plummeted 9.1% since Trump announced the tariffs. If the Taiwan stock market also declines after opening, it could fall by 1900 to 2000 points. Premier Su Tseng-chang convened a meeting to discuss measures to cope with the financial storm and to analyze the investment situation of Taiwanese businesses, planning to strengthen support for the supply chain. Investors need to carefully assess the risks.

The Taiwan stock market will be closed during the Qingming Festival holiday. Currently, Trump’s tariff policy has not shown significant effects, and many investors are worried about a potential steep decline when trading resumes.

U.S. President Trump's tariff measures have impacted the international financial markets, causing the U.S. stock market to decline for multiple days and enter a "bear market." During this period, the FTSE Taiwan Index, which is still trading, has fallen 9.1% since Trump's tariffs were announced. If this decline were to be applied to the Taiwan stock market, using the closing index of 21,298.22 points on April 2 as a baseline, if there is a 9.1% drop when it opens next Monday, it is expected to decline by about 1,900 points. Some financial experts predict that considering possible margin call selling pressure, the decline could reach as much as 2,000 points.

Trump's decision to impose tariffs globally has led to the U.S. stock market experiencing two consecutive days of declines exceeding 1,500 points, evaporating about $6 trillion in market value (about NT$198.6 trillion). Following the Qingming Festival, when the Taiwan stock market opens, it may also be affected by this wave of financial turmoil. The Premier has convened relevant departments to analyze financial measures to respond to possible market changes.

According to the performance of the FTSE Taiwan Index, it has declined 9.1% since Trump announced tariff policies. If this model is applied to the Taiwan stock market, assuming the FTSE Taiwan Index and the Taiwan stock market decline in sync when trading resumes next Monday, it is expected that the Taiwan stock market will drop by 1,900 points or more. Some analyses indicate that if the downward trend does not slow down, the conservative estimate for the Taiwan stock market's opening next Monday could be a decline of 1,800 points, and another drop of 2,000 points is not impossible. Investors are advised to adjust their cash holdings in advance or consider allocating to hedging assets.

In facing the opening next Monday, the governing unit stated that they will analyze the current financial condition of Taiwan based on the meeting with Zhuo Rongtai and review relevant response measures. They will also continue discussions based on the investment conditions of Taiwanese businesses and will issue relevant support measures if necessary.

Reminder: The above content is for reference only. Investors should carefully assess the risks and take responsibility for their investment outcomes when making decisions. Investments involve risks, and fund investments may have gains and losses. Please read the public offering document carefully before subscribing.