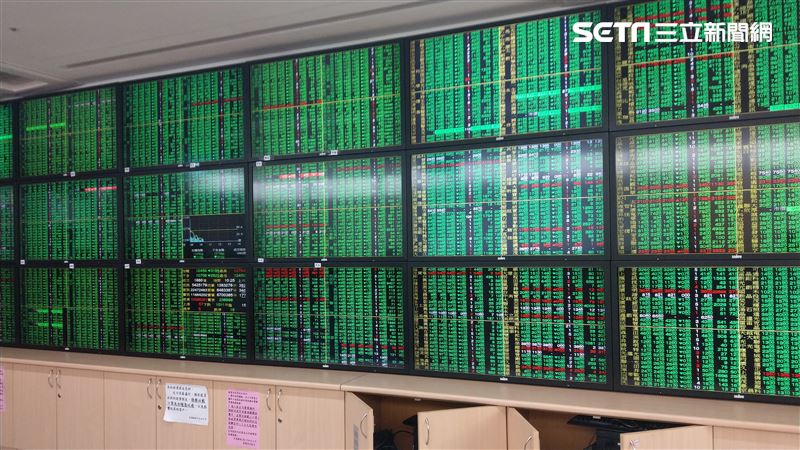

How is the opening situation of the Taiwan stock market? The "Futai Index" indicates it might drop by 2000 points.

- byVic

讀後心得

Due to the Qingming holiday, the Taiwan stock market is closed, and the impact of the Trump tariff policy from the United States has not yet been apparent. The FTSE Taiwan Index recorded a decline of 9.1% during the holiday. If the Taiwan stock market opens with a similar drop, it could decrease by approximately 1900 points, with some analysts even predicting it may fall below 2000 points. In response to potential market volatility, Executive Yuan Premier Su Tseng-chang convened a meeting to discuss financial measures and strategies to support the industrial chain. Investors need to cautiously assess risks and properly allocate their assets.

With the arrival of the Qingming holiday, the Taiwan stock market is temporarily closed. However, the impact of U.S. President Trump's tariff policy on the international financial market has yet to manifest, and many investors are concerned that the market may experience a significant drop after the holiday.

Recently, the U.S. stock market has continued to decline and has shown signs of a bear market, with the potential impact on the Taiwan stock market still under observation. According to the recent FT Taiwan Index, which has seen little volatility but is still trading, the index has plunged 9.1% since Trump announced a new round of tariffs. If we calculate based on the closing point of the Taiwan stock market before the Qingming holiday at 21298.22 points, if a similar 9.1% drop occurs after the market opens next Monday (the 7th), it is expected to drop by around 1900 points. Additionally, some analysts point out that if there is selling pressure in the market, the decline could reach 2000 points.

With the implementation of the tariff policy, the U.S. stock market has experienced significant declines for two consecutive days, with a total market value evaporating by approximately $6 trillion. After the Qingming holiday, how will the Taiwan stock market develop if it is impacted by this financial storm? Taking the unaffected FT Taiwan Index as an example, the index has already dropped to 1620 points since Trump's announcement of the tariffs. If the Taiwan stock market responds similarly to the FT Taiwan Index, a significant decline would be evident. Previous analyses predicted that if the situation continues to worsen, the opening point of the Taiwan stock market next Monday could even face a drop of 1800 points. If that occurs, combined with possible selling pressure, a collapse of 2000 points is not impossible. Investors should consider increasing their cash ratio or investing in hedging assets.

The Executive Yuan revealed that Executive Yuan Premier Su Tseng-chang convened relevant agencies to discuss the current state of Taiwan's financial market and response measures, and listened to the experiences of Taiwanese businesses in overseas investments to formulate support plans from the government, with appropriate explanations to be provided at that time.

- Investing involves risks; please evaluate carefully and bear the consequences when making decisions.

- Investment in funds may have profits or losses; please read the prospectus carefully before investing.