What is the opening situation of the Taiwan stock market? The "Futai Index" indicates it may fall sharply by 2000 points.

- byVic

讀後心得

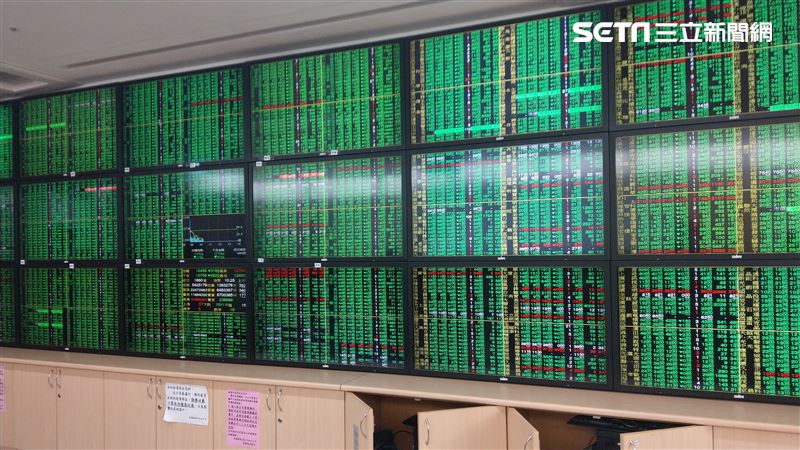

The Taiwan stock market was closed during the Qingming holiday. Trump's tariff policy has yet to show its effects; however, investors are worried that there will be a significant drop once the market opens. The U.S. stock market has plummeted due to the tariff policy, setting a new record for consecutive declines, with a market value evaporating by about $6 trillion. Observing the FTSE Taiwan Index, it has already plummeted by 9.1% since the announcement of the tariffs. If the Taiwan stock market opens and declines at this rate, it is expected to drop by about 1,900 points, possibly even reaching 2,000 points. The Executive Yuan has also convened a meeting to analyze response measures, and investors need to carefully assess the risks.

The Taiwan stock market will be closed during the Qingming Festival holiday, and the impact of Trump's tariff policy has yet to manifest, leaving many investors worried about a potential significant drop after the market opens.

U.S. President Trump has substantially adjusted tariffs, impacting the international financial market, causing the U.S. stock market to consecutively decline into a "bear market." During the Qingming holiday, although the Taiwan stock market was closed, the FTSE Taiwan Index (Taiwan Index) has already plummeted 9.1% since Trump's tariff announcement. Based on the closing point of 21,298.22 before the Qingming holiday, if a 9.1% decline occurs when the market opens next Monday, it is predicted to drop about 1,900 points. Experts point out that if additional selling pressure occurs, the decline could reach 2,000 points.

Trump's announcement of global tariffs led to the U.S. stock market recording consecutive drops exceeding 1,500 points over two days, with a total market capitalization evaporating by approximately $6 trillion (about NT$198.6 trillion). As a result, the Taiwan stock market could be affected by this wave of financial turmoil when it opens after the Qingming holiday. The Executive Yuan recently held a meeting, inviting the Central Bank, the Financial Supervisory Commission, and the Ministry of Finance to report on financial measures.

If the Taiwan stock market plunges like the U.S. stock market, what will be the details of the impact? Taking the Taiwan Index as an example, it has already sharply declined 9.1% since Trump's tariff announcement. Based on the closing point of 21,298.22 on April 2, if the market opens next Monday and declines similarly to the Taiwan Index, it is expected to drop about 1,900 points. Financial experts also analyze that if the decline continues to widen, the Taiwan stock market may conservatively estimate a drop of 1,800 points when it opens next Monday, emphasizing that if additional selling pressure arises, "seeing a collapse of 2,000 points would not be surprising," suggesting investors increase their cash ratio or allocate to hedging assets.

Regarding the situation for next Monday's opening, officials from the Executive Yuan stated that they have analyzed Taiwan's financial condition and stock and foreign exchange market status during the meeting, inventorying relevant measures, and continuously listening to the investment conditions of Taiwanese businesses abroad, discussing how the government can support the overall industrial chain and explaining related actions when necessary.

- Please note: This article is for reference only. Investors should carefully assess risks and take responsibility for the results of their investments.

- Investing involves risks; mutual fund investments can gain or lose. Please read the prospectus carefully before subscribing.