What is the opening situation of the Taiwan stock market? The "Futai Index" suggests it could plummet by 2000 points.

- byVic

讀後心得

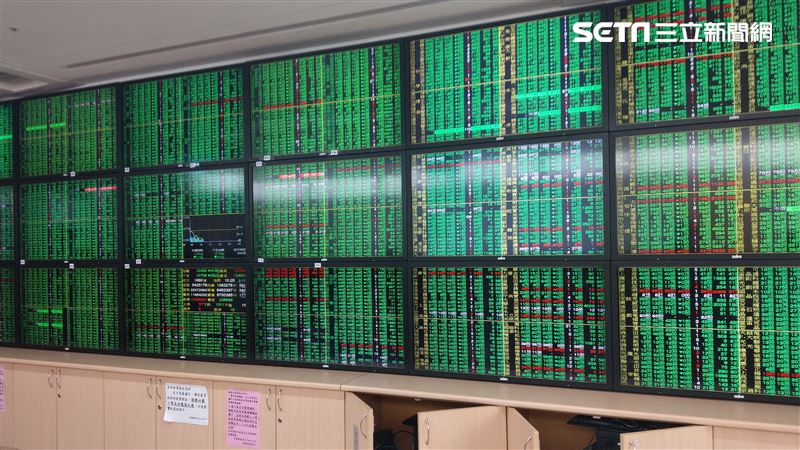

Taiwan's stock market was closed during the Qingming holiday, and the impact of Trump's tariff policy has yet to be seen, but many investors are concerned about a significant drop after trading resumes. The U.S. stock market has fallen for two consecutive days, with a total market value evaporating by approximately $6 trillion. Observing the FTSE Taiwan Index, it has already plummeted by 9.1%. If applied to the Taiwan stock market, it could potentially drop by 1,900 points after opening, or even reach 2,000 points. Premier Su Tseng-chang has convened a meeting to discuss financial measures to respond to the possible impact. Investors need to cautiously assess the risks.

The Taiwan Stock Exchange will be closed during the Qingming Festival holiday. Due to the fact that the impact of President Trump's tariff policy has not yet been evident, many investors are worried about a significant drop when the market opens.

U.S. President Trump's tariff policy has caused a shock to the international financial markets, such as the U.S. stock market continuously dropping over 1500 points, entering a "bear market." Even though the Taiwan stock market did not trade during the holiday, the FTSE Taiwan Index (FTSE Taiwan) has already plummeted by 9.1% during the market closure. If we apply this drop to the Taiwan stock market, based on the closing point of 21298.22 before the holiday, if a 9.1% drop occurs when the market opens next Monday, it would result in a decline of about 1900 points. Additionally, according to analysis by financial experts, if selling pressure from margin calls is factored in, the drop in the Taiwan stock market could reach as much as 2000 points.

Since Trump announced global tariffs, the U.S. stock market has seen consecutive drops of over 1500 points, with a market value evaporating by about 6 trillion USD (approximately 198.6 trillion NTD). Many anticipate that the Taiwan stock market may also be affected by this wave of financial turmoil after the Qingming Festival holiday. The Executive Yuan convened a meeting to discuss financial strategies with the central bank, the Financial Supervisory Commission, and the Ministry of Finance.

According to data from the FTSE Taiwan Index, since Trump announced the reciprocal tariffs, it has plunged by 9.1%, with the current closing point at 1620. If we take this into account, the Taiwan stock market next Monday, based on the April 2 closing point of 21298.22, and a 9.1% drop when it opens, would decline by about 1900 points. Previously, financial writers also predicted that based on the drop of the FTSE Taiwan Index, if there is no rebound by next Monday, the Taiwan stock market may initially drop by 1800 points. Additionally, some analysts pointed out that if there is a decline of 1800 points plus selling pressure from margin calls, a collapse of 2000 points would not be surprising.

Regarding the stock market opening next Monday, government officials stated that today's meeting analyzed Taiwan's financial structure and the characteristics of the stock and exchange markets, reviewed relevant measures, and listened to the situation of Taiwanese businesses' overseas investments. They will continue to explore how the government can support the overall industrial chain, and any relevant measures will be announced in a timely manner.

Investors must self-assess risks and make informed decisions. Investing carries risks, and fund investments can both gain and lose. It is advised to read the relevant prospectus carefully before subscription.