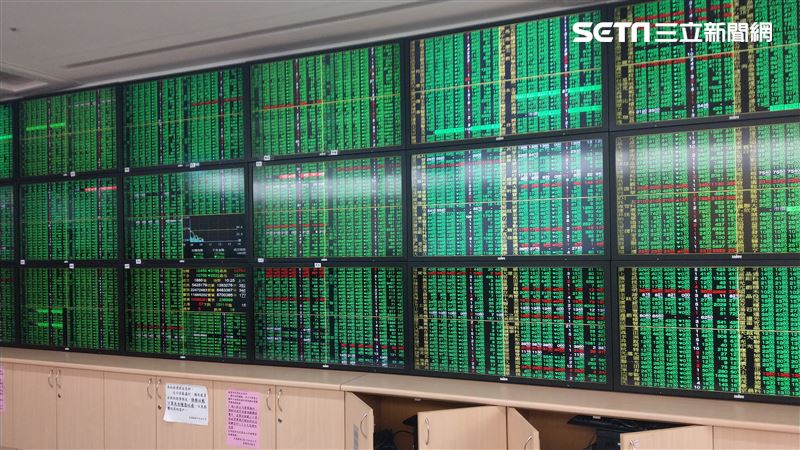

Title Rewrite Suggestion: The Opening Situation of Taiwanese Stocks is Severe, "Futai Index" Reveals a Warning of Possible 2000-Point Plunge.

- byVic

讀後心得

According to the Financial Center report, the Taiwan stock market is closed due to the Qingming Festival holiday, and the impact of Trump’s tariff policies has yet to be seen. However, many investors are worried that there will be a significant drop after the market opens. The U.S. stock market has been declining for several days due to these tariff policies, with a total market value evaporating by about 6 trillion dollars. During this period, the FTSE Taiwan Index has already plummeted by 9.1%. If the Taiwan stock market follows suit after it opens, it could drop nearly 1,900 points, or even 2,000 points. Council of Ministers Premier Su Tseng-chang has held a meeting to discuss response measures with relevant agencies and analyze the current situation of Taiwan's financial market. Investors need to carefully assess risks and be prepared for hedging.

The Taiwan stock market will halt trading during the Qingming holiday, and the impact of U.S. President Trump's tariff policy has yet to materialize, leading many investors to worry about a potential drop when trading resumes. The U.S. has caused shocks to international financial markets, with U.S. stocks continuously declining and trending towards a "bear market." Although the Taiwan stock market is closed during the Qingming holiday, the trading results of the FTSE Taiwan Index show that since the announcement of the tariff policy, it has already plummeted by 9.1%. If this decline is applied to the Taiwan stock market, using the closing point of 21,298.22 on April 2, it is estimated that if the market drops by 9.1% when it opens next Monday, it could fall by about 1,900 points. Some analysts also indicate that considering forced selling pressures, the drop could even reach 2,000 points.

Trump's announcement of global tariffs caused the U.S. stock market to plummet, with over 1,500 points lost over two consecutive days, totaling about 6 trillion dollars in market value evaporated. After the Qingming holiday, the Taiwan stock market may be impacted by this financial storm. In response to potential effects, the Executive Yuan held a meeting inviting the Central Bank, the Financial Supervisory Commission, and the Ministry of Finance to report on financial measures. If the Taiwan stock market experiences a significant decline in the future, according to the downward trend of the FTSE Taiwan Index, it is estimated that it could face a drop of 1,800 points after trading opens. It was also emphasized that if such a situation occurs, investors should increase their cash ratio or diversify investments into hedging assets as early as possible.

Regarding the market opening next Monday, government officials pointed out that during the meeting, they discussed Taiwan's current financial structure and the characteristics of the stock and currency markets, and reviewed relevant response measures, continuously listening to analyses of Taiwan businesses' investment situations abroad and studying how the government can support the overall industrial chain, with related practices to be explained in a timely manner.

- Investors need to carefully assess risks and are responsible for their investment outcomes.

- Investing involves risks. Fund investments can result in both gains and losses. Please read the prospectus carefully before subscribing.