Trump's equivalent tariffs have sparked a global trend. Will this lead to a trade war?

- byVic

讀後心得

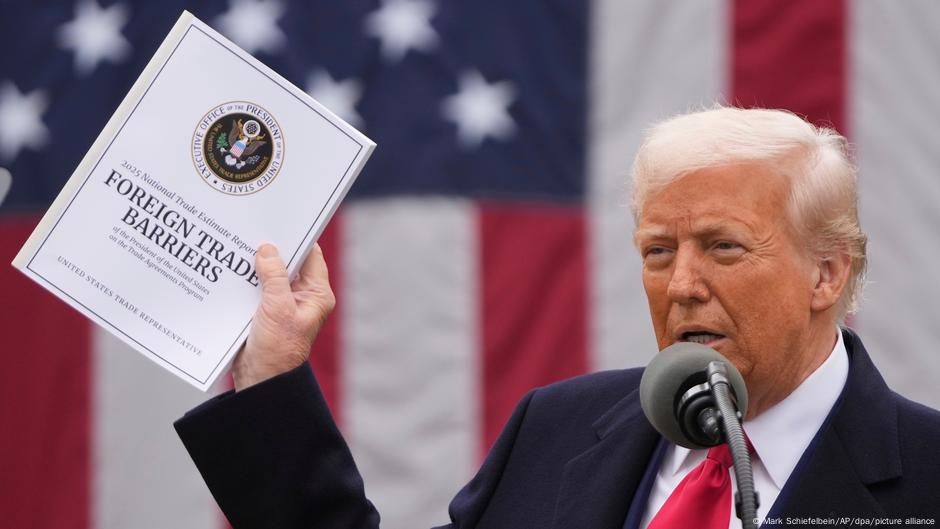

On April 2, U.S. President Trump announced new tariffs that will affect multiple countries, including Japan and China. The baseline tariffs will take effect on April 5, while the highest tariffs will be implemented on April 9, adding to existing tariffs on steel, aluminum, and automobiles. The U.S. industrial sector has expressed concerns that this will impact investment and employment and may lead to an economic recession. The EU and countries like Italy are preparing countermeasures in response. Additionally, analysts predict that U.S. growth could lose 1-1.5% as a result. The total tariffs faced by Chinese products will reach 54%.

On April 2, the President of the United States announced new tariff measures. The targets of these measures include not only the United States' closest allies, like Japan, but also rivals such as China. A 10% baseline tariff will take effect on April 5, while the highest tariffs for different countries will start on April 9. These new tariffs will be added on top of the steel, aluminum, and automotive tariffs that the U.S. currently imposes on China.

The domestic industrial sector in the U.S. reacted swiftly. A leader from the National Association of Manufacturers stated, "Many American manufacturers are already facing the challenge of low profit margins. The high costs of the new tariffs will threaten investment and jobs, and impact the supply chain, which also undermines America's competitiveness in global manufacturing." A representative from the Consumer Technology Association expressed a similar view: "The global reciprocal tariff policy pushed by the president will lead to rising inflation, job losses, and may trigger a recession in the U.S. economy."

The President of the European Commission stated, "We are finalizing a set of countermeasures in response to the U.S. steel tariffs. If negotiations fail, we are also prepared to strengthen countermeasures further." The Prime Minister of Italy was more cautious, saying, "We will work diligently to reach an agreement with the U.S. to avoid a trade war that ultimately weakens the West in favor of other global competitors."

The perspective of investors was provided by a strategic analyst from Deutsche Bank, who pointed out that the new U.S. tariff levels exceeded the worst expectations and predicted that this could result in a 1-1.5% loss in U.S. economic growth this year. For China, following a 34% tariff, the total tax rate on its products will reach 54%. The Chief Economist of a consulting firm also remarked that the scale of the new reciprocal tariffs exceeded expectations, predicting that under the influence of the new tariffs, China's GDP may decrease by 0.5%, and the Eurozone and Japan may see a decline of about 0.2%.

- Tariff effective dates: Baseline tariff (April 5), Highest tariff (April 9)

- Total tax rate imposed on Chinese products: 54%

- Projected decline in U.S. economic growth: 1-1.5%

- Expected decline in China’s GDP: 0.5%

- Expected decline in Eurozone and Japan's GDP: Approximately 0.2%