【China Power Competes for Computing Power - The Second Wave】Heavyweights from Taiwan and the United States Gather in Taiwan to Establish a Computing Power Center, as a 75-Year-Old Tech Giant Emerges Again.

- byVic

讀後心得

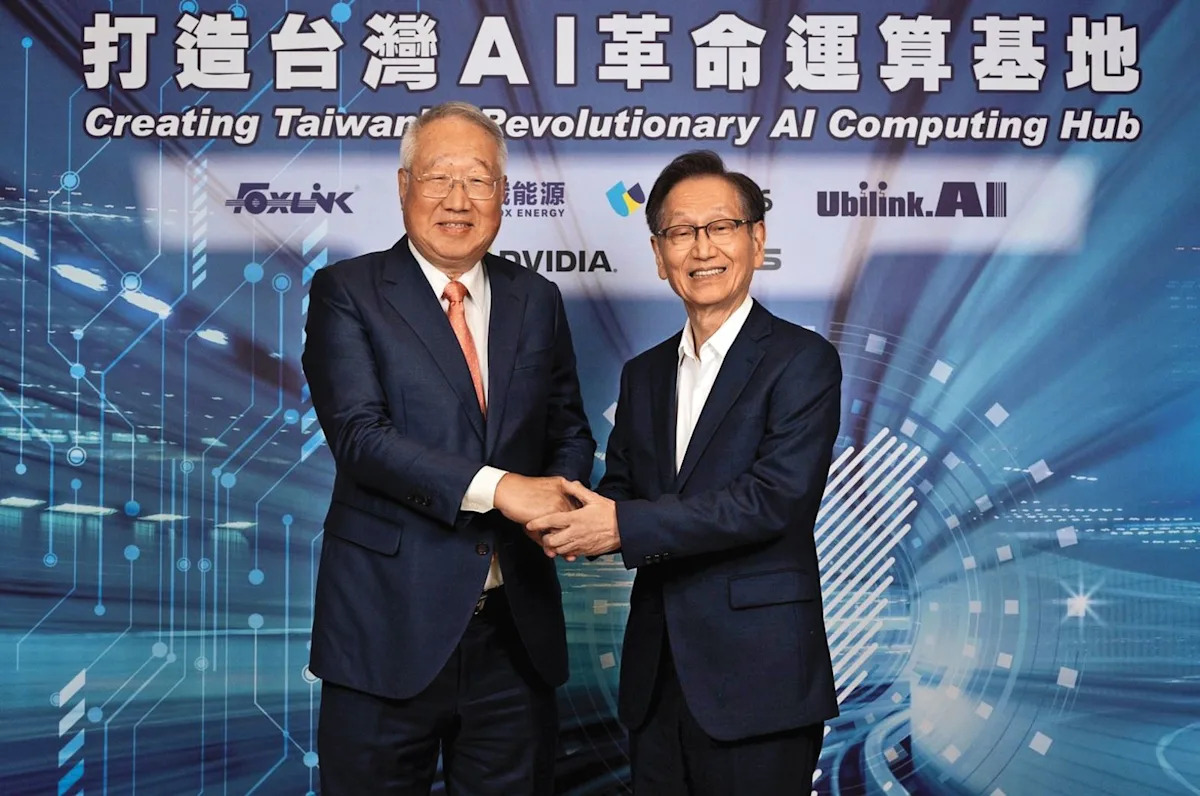

Shih Chong-tang (right) is an important ally of Nvidia, assisting Chen Tsu-chang (left) in becoming Taiwan's leader in computing power. Industry insiders point out that the cost of AI computing power is high, with Nvidia's HGX H100 servers priced at tens of millions, making it affordable only for large enterprises. Take CoreWeave as an example; this company initially used Nvidia chips to mine Ethereum but has transformed into AI computing and received investment from Nvidia, gaining a chip supply advantage that attracted Microsoft to sign contracts for chip procurement, intensifying market competition. Chunghwa Telecom has also invested in computing power centers, riding the wave of affordable language models to help enterprises utilize AI in robots, PCs, and mobile devices. IDC predicts that global AI spending will increase from $227 billion this year to $20 trillion by 2030, with demand in Taiwan's public cloud and data center sectors rising rapidly. Shih Chong-tang is partnering with Chen Tsu-chang to build Taiwan's strongest supercomputing center, while Tai Chung-he is collaborating with several companies to plan the establishment of the largest AI data center. Major international companies Meta, Microsoft, and Amazon are also looking to enter the Taiwanese data center market, with the driving force being Lai Yi-lin, chairman of Ruya Investment, who actively seeks to make Taiwan the largest computing power base.

Jason Huang (right) is an important ally of Nvidia, helping Jensen Huang (left) become the dominant force in computational power in the country. A tech industry insider stated, "The cost of AI computational power is extremely high; for example, the price of the Nvidia HGX H100 server can reach tens of millions. Only large enterprises can afford it." Taking CoreWeave as an example, the Ethereum mining company that initially used Nvidia chips has transformed into an AI computing company and received investment from Nvidia. Due to their long-term cooperation, the acquisition speed of AI chips has surpassed that of CSPs (cloud service providers), and even Microsoft has rapidly signed contracts to seize chips. "Whoever can obtain AI chips now is the winner." This has sparked a wave of competition for new computational power centers.

"Chunghwa Telecom's investment in AIDC (computational power centers) coincides with the emergence of affordable large language models like DeepSeek, while other competitors are developing along the lines of low costs and open sources, which helps attract enterprises to actively invest in AI. As AI applications expand to robots, PCs, mobile phones, and other edge computing devices, they will assist enterprises in developing various chatbots," said a market participant.

In the face of continued growth in global AI spending, projected to soar from $227 billion this year to $20 trillion by 2030, "the demand for local public cloud infrastructure construction, data center hosting services, and enterprises building private clouds or edge data centers in Taiwan will rapidly increase." Given the massive demand for AI computational power, it has attracted not only past telecom competitors like FarEasTone and Taiwan Mobile but also stronger large corporate consortiums to compete with Chunghwa Telecom.

For example, targeting AI business opportunities, Asus Chairman Jason Huang has successfully defeated competitors like Quanta, Gigabyte, and Supermicro, joining forces with Pegatron Chairman Jason Hwang to create Taiwan's strongest supercomputing center. Similarly optimistic about the AI computational power opportunities is Acer co-founder Stan Shih, who at 75 years old is collaborating with Wistron, Foxconn, and Pegatron, and has founded a startup company called Zettabyte, leveraging Silicon Valley technology to develop AI software, planning to create the largest AI data center in Taiwan.

Additionally, international cloud giants like Meta, Microsoft, and Amazon are also interested in establishing IDCs in Taiwan, with reports indicating they may choose to locate in the A-Top area of Taoyuan. Their behind-the-scenes driver is an investment chairman who started in real estate, having invested over 20 billion TWD in land acquisition five years ago, recently attracting Singapore's Keppel Group and two international data center operators, aiming to become Taiwan's largest computational power base.