Tariffs Impact the Market, Various Sectors Urgently Seek U.S. Treasury Secretary, But Reports Indicate Limited Influence.

- byVic

讀後心得

U.S. Treasury Secretary Mnuchin received a large number of text messages after Trump announced the tariff measures, but he was not the main driving force. Many financial executives hoped that Mnuchin could persuade Trump to adjust the policy, only to find that he was responsible merely for providing market impact analyses. Trump's tariff policy was primarily formulated by his core advisory team, leading to consecutive market declines and raising concerns about an economic recession. Although the market experienced significant volatility, Trump dismissed the short-term impacts, insisting on revitalizing American manufacturing. Some Republicans began proposing legislation to limit tariff powers, reflecting concerns about the policy.

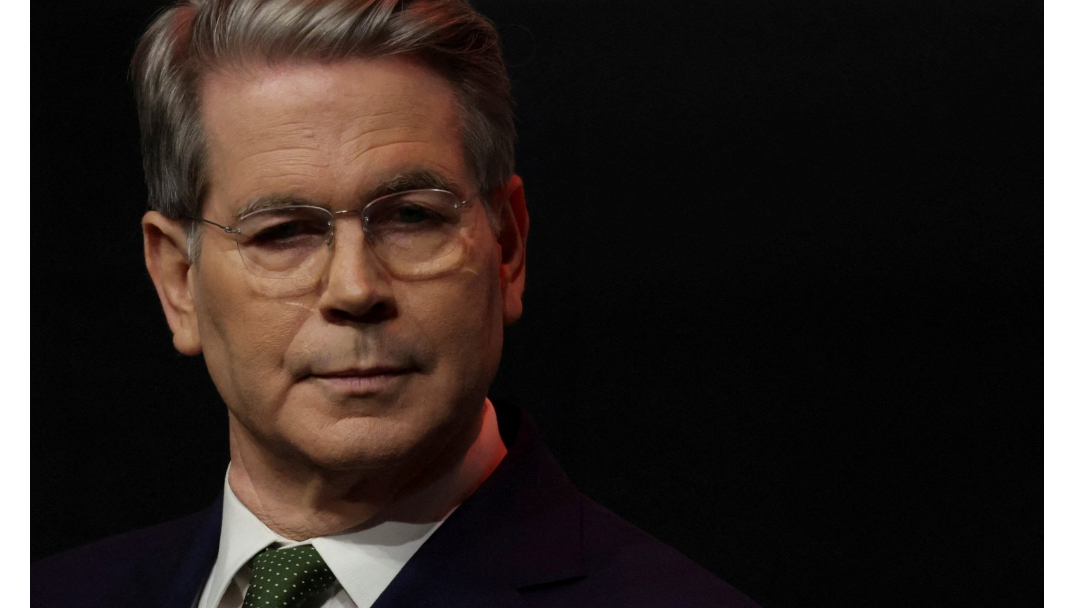

On April 2, U.S. President Trump announced tariff measures that dealt a heavy blow to the U.S. and global markets over two consecutive days. Reports indicate that U.S. Treasury Secretary Mnuchin received a large number of messages from various sectors, but in reality, he was not a key player in this decision-making process. Several insiders revealed that many hedge fund managers and senior financial executives tried to contact Mnuchin, hoping he could explain to Trump the potential damage of extreme tariffs to the economy and the market impact. At a White House meeting, Mnuchin primarily provided analysis regarding the market impact of different tariff levels, rather than being one of the decision-makers.

Reports indicate that the core of this tariff measure was formulated by Trump's core advisory team, with many details being finalized only at the last minute before the announcement. Trump's plan was mainly based on the advice of presidential adviser Navarro and Commerce Secretary Ross, with the U.S. Trade Representative also playing a significant role. Although Mnuchin remains an important member of Trump's economic team, his focus is on internal matters related to tax reform and he did not participate in tariff negotiations with countries like China.

Trump intends to reshape the American economy and promote the "Made in America" initiative, which conflicts with the long-standing global trade model of Wall Street. Some heavyweight Republican lawmakers have even begun to worry that this could have adverse effects in Congress. The market experienced significant drops over the past two days, with the S&P 500 index falling to a new low in nearly 11 months, raising concerns about economic recession. Executives from companies that previously supported the Trump administration now face the threat of a potential downturn. Despite poor market performance, Trump remains steadfast in his tariff policy and asserts that large corporations do not care about the impact of this policy.

In the past few days, the market's plunge has sparked anxiety among officials, who are closely monitoring subsequent trading situations; however, the White House also realizes that any changes in policy can only be decided by Trump himself. Reports suggest that Trump’s position on tariffs considers long-term economic interests rather than short-term market fluctuations. Another adviser criticized the manner in which the tariffs were introduced and suggested that the White House should arrange for economists and business leaders to discuss the policy on television.

Before this wave of tariff announcements, some senior Wall Street executives had already begun privately seeking help from Mnuchin. At the same time, Trump supporters in Congress are showing some signs of backlash, with Senator Grassley and three other Republicans jointly proposing a bipartisan bill to attempt to return the power to impose tariffs to Congress, requiring that new tariffs receive congressional approval within 60 days. The Senate Majority Leader also stated that he would consider this bill and revealed that Republicans are closely monitoring market conditions, hoping to see results from Trump’s plan soon.