Taiwan's stock market faces challenges when it opens on Monday. The Financial Supervisory Commission has launched three measures to stabilize the market, and banks and exchanges are also taking responsive strategies.

- byVic

讀後心得

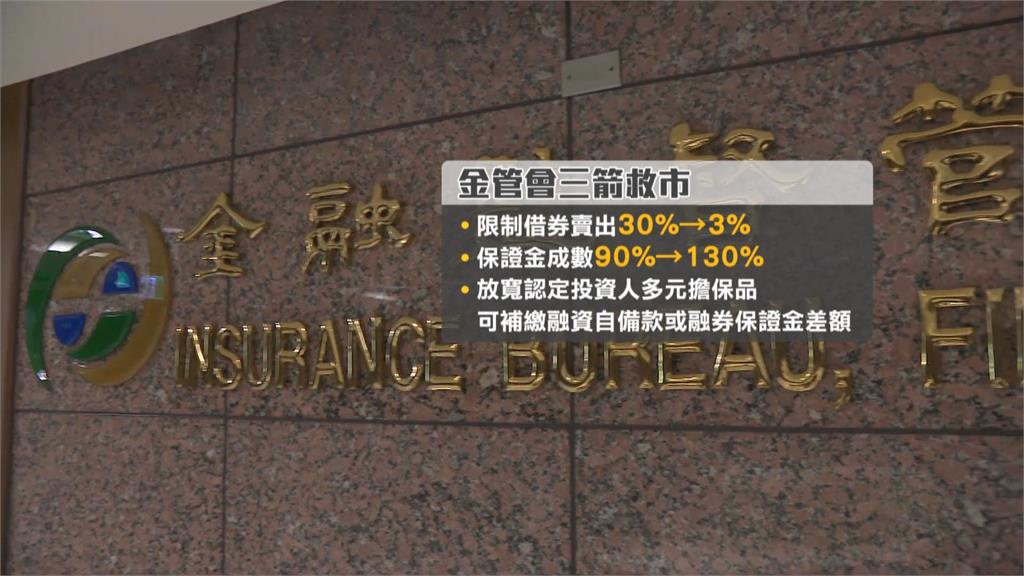

Trump's tariff policy has impacted global stock markets, leading to a risk of a crash for the Taiwan stock market as it opened on Monday. The Financial Supervisory Commission urgently launched three measures to stabilize the market, including reducing the limit on short selling from 30% to 3%, and increasing the margin ratio to 130%. In addition, the stock exchange will also announce response measures. The market atmosphere is pessimistic, and the financial sector is prepared to take further action to address a potential stock market crisis.

Trump's tariff policy has had a significant impact on global markets, particularly affecting stock markets in Europe, the United States, and Asia, which have all been severely hit. The Taiwan Stock Exchange faces enormous pressure before the market opens on Monday, with a potential for a significant drop without trading volume. To address this crisis, the Financial Supervisory Commission has decided to implement three measures before the market opens, including reducing the short-selling limit to 3% and increasing the margin requirement to 130%. The stock exchange also announced emergency measures on Monday before the market opening to counteract the severe market fluctuations.

The Premier has warned that the stock market in Taiwan will face a shock, as Trump's tariffs have significantly affected global stock markets. After a continuous four-day market closure, the opening of the Taiwan Stock Exchange is expected to trigger a large response. In the face of this challenge, the Financial Supervisory Commission has acted swiftly to stabilize the market. The Deputy Director pointed out that the current regulation on short-selling is set at 30% based on the average trading volume of the previous 30 business days, and the new rule will reduce this ratio to 3% between April 7 and 11. Additionally, the margin requirement for short selling will be raised from 90% to 130%.

As the market focuses on the Financial Supervisory Commission's subsequent actions, there are questions about whether a comprehensive short-selling restriction or ban will be implemented. The Deputy Director emphasized that they will continue to monitor international financial market dynamics and the situation of the domestic capital market to adjust relevant stabilization measures in a timely manner. The three proposed measures took effect on April 7, and the stock exchange held a press conference before the market opened on Monday to announce corresponding countermeasures.

Analysts indicate that the likelihood of the National Security Fund intervening immediately is low, and the declines resulting from the initial market response will take time to digest. In light of the sluggish market sentiment, the financial and economic departments have heightened vigilance, prepared to implement short-selling restrictions or bans, and are on standby to respond to market challenges.

Investors should remain cautious regarding the current situation, carefully assessing risks and taking responsibility for investment outcomes.