The impact of U.S. tariff policies on the global economy is deteriorating, with the Nikkei index plummeting 955.35 points last Friday, a decline of 2.75%.

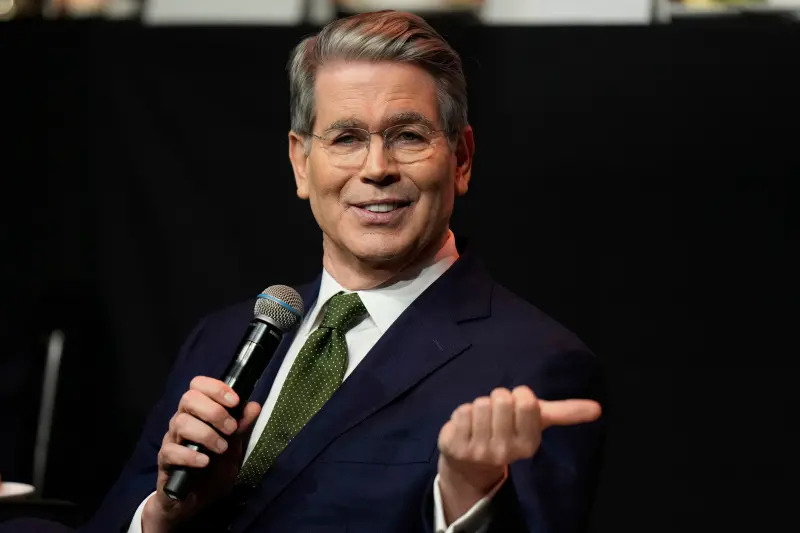

Japan's stock market fell last Friday due to concerns that U.S. tariff policies would impact the global economy. The Tokyo Stock Exchange First Section Index dropped by 3.37%, closing at 2,482.06 points; the Nikkei 225 index declined by 2.75%, ending at 33,780.58 points. Concerns over the trade war intensified, with the Tokyo Stock Exchange index down 12% from its March highs. Ikuo Mitsui, a fund manager at Aizawa Securities, stated that the expected damages from tariffs would be greater than anticipated, leading to a rise in market risk aversion. He has reduced his investments in technology stocks and instead increased holdings in companies that rely on domestic sales. In terms of individual stocks, Shionogi and East Japan Railway Company saw their share prices rise, while Mitsubishi UFJ Financial Group and Renesas Electronics experienced declines.