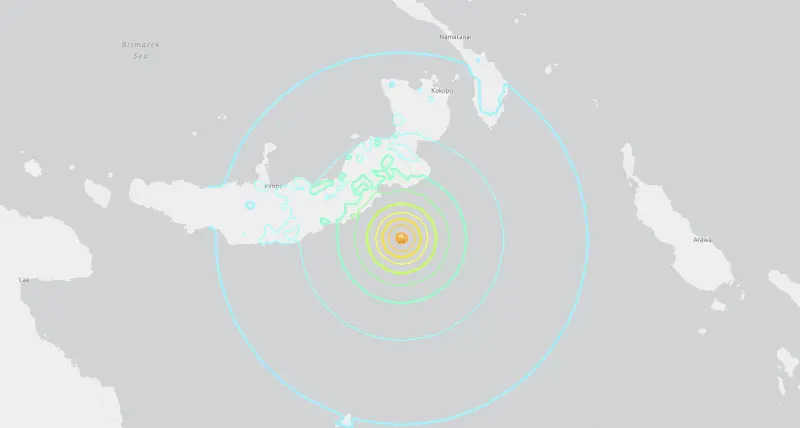

A magnitude 6.9 earthquake strikes! Papua New Guinea issues a tsunami warning.

A 6.9 magnitude earthquake occurred in Papua New Guinea at 6 a.m. on the 5th, with the epicenter located 194 kilometers east of Kimbe in the West New Britain Province, at a depth of 10 kilometers. The U.S. Tsunami Warning Center has issued a tsunami warning, predicting that some coastal areas may experience waves 1 to 3 meters high, while the Solomon Islands may face wave heights below 0.3 meters. It is currently unclear whether there are any reports of damage or casualties. A similar magnitude earthquake also occurred in the country last March, resulting in several deaths and significant property damage. Papua New Guinea is located on the Pacific Ring of Fire, which is one of the most seismically and volcanically active regions in the world.