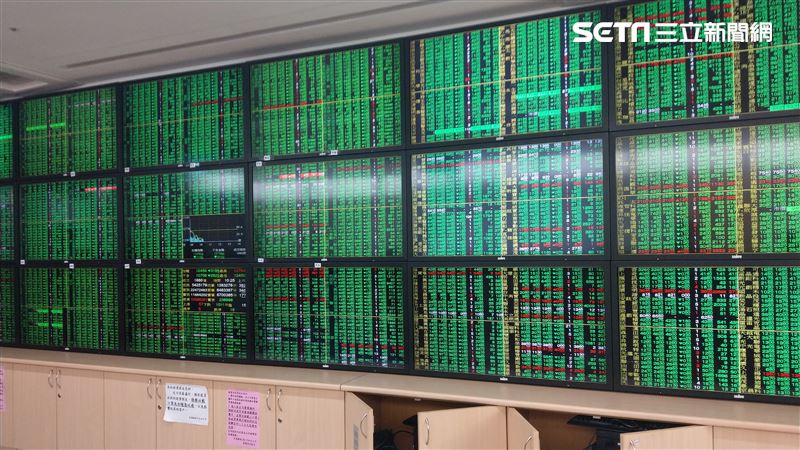

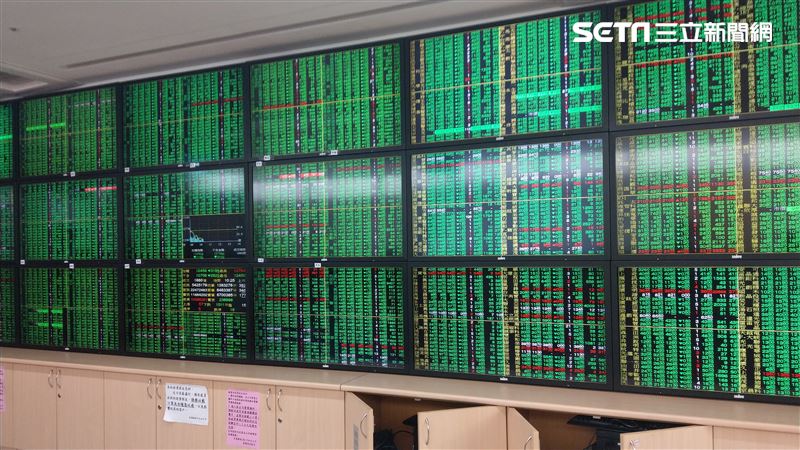

The impact of the "32% tariff" from the United States! Lai Ching-te convened a meeting with representatives from the ICT industry and will invite traditional industries and small and medium-sized enterprises tomorrow... The spokesperson for the Presidential Office has made a response.

Premier Su Tseng-chang stated that President Lai Ching-te has instructed to prioritize stabilizing the economy and supporting industries in response to the 32% tariff increase imposed by the United States on Taiwan. The Executive Yuan has launched a 88 billion relief plan. Lai Ching-te held discussions with business representatives at the official residence to discuss countermeasures and will invite representatives from traditional industries and small and medium enterprises tomorrow to hear their needs to ensure industry competitiveness. Attendees believe the government should strategize for future actions, grasp negotiation leverage, and develop medium- to long-term response strategies.